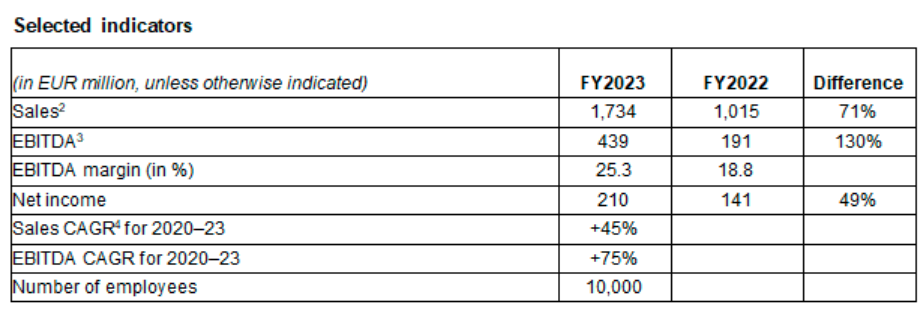

The Czechoslovak Group (CSG; Group), an industrial and technological holding company, announced its audited consolidated financial results for 2023. CSG increased its revenue by two thirds in 2023, and its EBITDA more than doubled.

Overview of key indicators:

– Group revenue for 2023 was EUR 1.73 billion, an increase of 71% compared to the previous year.

– EBITDA for 2023 came to EUR 439 million and thus more than doubled year-over-year.

– The EBITDA margin was 25.3% last year—up by a third compared to the previous period.

– The Group’s net profit for 2023 was EUR 210 million, a 49% increase over the previous year.

– The vast majority of CSG’s production (51%) went out to European countries (excluding Ukraine).

– Two thirds of CSG’s sales were generated in NATO member states, the remaining third in the rest of the world (mainly in Ukraine, Indonesia, Vietnam, and Morocco).

– More than 60% of the Group’s sales were generated by the CSG Defence division, which contains its companies focused on the production of military land systems and large caliber ammunition. A fifth of its sales were generated within the small caliber ammunition division (CSG Ammo+).

– The defence industry accounted for more than 70% of the Group’s revenue. In addition to the CSG Defence division, customers’ defence contracts were also placed in other divisions: in the CSG Aerospace division, they accounted for 63% of its sales, in the CSG Ammo+ division 13%, and in the CSG Business Projects division 30%.

– In 2023, the Group issued EUR 181.3 million of bonds.

– As of the end of 2023, the CSG Group employed more than 10,000 employees at 37 production sites, mainly in the EU countries and the United States.

– In 2023, CSG supplied its products and services to more than 55 countries worldwide.

Zdeněk Jurák, Member of the Board of Directors and Chief Financial Officer of the Group, commented on last year’s results, stating: “CSG’s growth in 2023 was driven primarily by two strategic sectors in which we have been active for a long time, specifically the production of large-caliber ammunition and the production of military land systems. In both of these cases, this is healthy, organic growth, which we achieved due to the strength of demand, but also thanks to our investments into expanding production capacities and increasing labor productivity.”

Summary of Developments in the Group’s Main Markets

The year 2023 brought CSG a clear consolidation of its strategic position on its key markets, well-illustrated by the acceleration of growth in the Group’s sales and operating profit as well as its successful entry into new markets, mainly due to the expansion of its production capacity and the opening of new outlets.

Last year, CSG’s economic activities were influenced yet again by growing demand for most of the Group’s flagship products. This mainly manifested in the segments involved in defence-industry manufacturing (Defence), small-caliber ammunition production (Ammo+) and aviation products and services. Last year’s developments were marked by the continuing war in Ukraine and conflicts in the Middle East.

The continuing Russian aggression in Ukraine has resulted in a distinct increase in defence expenditures in the majority of European countries, especially in eastern and northern Europe. This is accompanied by increased pressure to expand production capacities and—in light of the high consumption of large-caliber munitions and ground equipment especially—the need for faster restocking of materiel and equipment in the arsenals of NATO member states. Many European countries, including the Czech Republic, are indicating further increases of defence expenditures within this context.

CSG has responded to market pressure with major investments into business development—above all into strengthening its production capacities and increasing productivity, promoting technological innovations, developing new products, and strengthening its financial position via debt financing and bond emissions.

The CSG Defense Division: Standing at the Forefront of the Group’s Growth

The main driver of CSG’s growth in 2023 was CSG Defence, a division focused on supplying defence products and services, primarily land systems (military land systems) and large caliber ammunition. With sales of EUR 1.1 billion, CSG Defence contributed more than 60% to the Group’s overall results.

In the realm of large caliber ammunition, CSG has successfully increased its production several fold since the beginning of the war in Ukraine. It also invested significantly last year into expanding its production capacity in Slovakia and Spain. The CSG Defence division’s companies have additionally long been providers of technological know-how to countries seeking localization of production and self-sufficiency in crucial strategic commodities, as artillery ammunition recently emerged as such a commodity.

CSG is similarly also expanding production and investing in the segment of military land systems production, where it has been successful in bringing to market, for example, self-propelled howitzers, which are products of its own development. Zdeněk Jurák notes: “Orders for military equipment are not just about sales; they’re also about after-sales service. CSG has the ambition and know-how to ensure the life cycle of its equipment for customers, which should not only guarantee the stability of the Defence division’s results, but also maintain high quality for the equipment on the customer’s side in the long term.”

Virtually all the companies in the Defence division continued to recruit new employees in the past year. Excalibur Army alone recruited around 400 workers for manufacturing professions and also for design, technology development, and sales; Tatra Defence Vehicle was hiring as well; and MSM Group [5] has almost doubled its workforce in the last year and a half.

Development of the New CSG Ammo+ Division

The second key pillar of CSG’s business, the production of small caliber ammunition, underwent a major shift in 2023.

The majority of the Group’s production in the small caliber ammunition segment (approximately 87%) was directed toward the civilian market, with sport and recreational shooting (hunting) having seen a revival last year, particularly in the USA, which was particularly beneficial for the Fiocchi Group’s US production facilities.

The acquisition of Fiocchi Munizioni in 2022 and its full integration into CSG last year laid the foundation for a new, separate pillar of our business, which we have now covered through our newly created CSG Ammo+ division. Its production comes from small caliber ammunition manufacturing plants in Italy, the UK, and the USA.

The full integration of Fiocchi into CSG is reflected in an increase in the Group’s key indicators for 2023[6]: Fiocchi contributed EUR 330 million (approx. 19%) to the Group’s total revenue for this year.

In addition to increased demand, CSG also faced changes to its supply chains in 2023 in the area of raw material distribution; this required us to arrange new sources of key raw materials, particularly for ammunition cartridges in all categories.

The Growing Aviation Market Is Boosting CSG Aerospace’s Business

Increasing air traffic over Europe for both passenger and cargo transport, the forced change of flight routes caused by the closing-off of Russian airspace for Western airlines, and the increased need to protect airspace, especially on NATO’s eastern border, have all created increased pressure on the supply of aviation equipment and services of all kinds. At CSG, this meant benefits last year for the companies in its Aerospace division. These include successful manufacturers of radar and security systems, recording technology, air traffic management systems, and drone operations, as well as aircraft repair facilities.

The Aerospace segment contributed EUR 225 million to the Group’s overall results in 2023, with deliveries to defence customers accounting for 63% of this and deliveries for civil use accounting for the remaining 37%. The Group is an important player in the aerospace sector; For example, radar air traffic control systems produced by Pardubice-based company Eldis currently cover more than 90% of India’s airspace. Meanwhile the Job Air Technic repair facility in Mošnov is one of Europe’s leading service centers for Airbus A320 and Boeing 737 series aircraft.

Division CSG Mobility: preparation for growth

Demand for the outputs of the CSG Mobility division, which primarily consists of Tatra Trucks, a truck manufacturer based in Kopřivnice, Slovakia, and DAKO-CZ, a manufacturer of braking systems for rail vehicles based in Třemošnice, Czech Republic, has long been chafing against a production capacity ceiling. Tatra Trucks—which makes trucks renowned for their unique chassis design for off-

road driving—is therefore currently investing heavily into expanding its production facilities and increasing productivity, with the aim of doubling production capacity by 2027.

The CSG Mobility division contributes four percent of the Group’s total revenue.

A New Addition to the CSG Business Projects division

In December 2023, CSG announced the acquisition of a majority share in Armi Perazzi, an Italian maker of luxury shotguns for elite sportsmen and hunters. Despite its relatively limited production, the Perazzi brand enjoys high prestige in the world shooting community; it is thus a welcome enrichment of CSG’s portfolio of top-rate, hand-crafted brands based on precision engineering, gathered into its CSG Business Projects division. This division includes members such as Elton hodinářská, the maker of Prim mechanical watches, and Karbox, a specialized manufacturer of superstructures, containers, and other logistics technologies.

Impact of the Conflict in Ukraine

CSG’s companies can be counted among the major European manufacturers of military equipment and ammunition that the Czech and other NATO governments are supplying as part of their joint support for the defence of Ukraine. Meanwhile one side effect of the conflict in Ukraine is an increased need for allied countries to replenish their stocks of military equipment. In recent months this has led to a fundamental change in the attitude of governments, investors, and the public toward the defence industry as a whole and toward its strategic role as an important security pillar for the global democratic community.

Project for the Acquisition of Kinetic Group

In 2023, CSG announced that it had reached an agreement on the purchase of the Sporting Products division (now named Kinetic Group) from Vista Outdoor (NYSE: VSTO). Kinetic is a leading global manufacturer of small-caliber ammunition, headquartered in Anoka, Minnesota. CSG hopes that this acquisition will bring mutual broad synergy to its business opportunities on international markets and an overall strengthening of the Group’s presence on the American market. This transaction in the amount of EUR 1.91 billion is subject to approval by the corresponding regulators and shareholders of Vista Outdoor.

Investments

In 2023, CSG launched several important investment projects to significantly expand its production and storage capacity, and to increase its efficiency and productivity with the help of advanced technologies as well. This included investments by its companies:

Excalibur Army commenced the construction of a new assembly hall and administrative facilities. The new premises will primarily serve for the assembly of ground vehicles for security and rescue forces. Upon completion, the company’s employee count is expected to grow to 150% of its current level.

Tatra Defence Vehicle has also launched a project for building a new, modern, and environmentally friendly production hall at its Kopřivnice site. Last year, project work and construction permit procedures were already underway. Construction of the hall’s planned highly modern welding shop will include the installation of the latest robotic technologies. This project, which includes the installation of photovoltaic panels on the building’s roof surfaces, will require an investment of several hundred million crowns and will, among other benefits, create as many as 60 new jobs. The company plans further investments valued at tens of millions of crowns to expand the capacity of the current paint shop. The new hall and paint shop may be operational by the end of this year and the beginning of next year respectively.

The MSM Group, also part of CSG, similarly invested tens of millions of euros into modernizing technology and semi-automating operations at its production plants in Slovakia and Spain last year. A significant part of these resources went toward the reconstruction of the premises and the robotization of production at the ZVS holding company plants—this has in turn enabled a threefold production increase just at the Slovakia-based Snina plant alone. The investment also targeted the VOP Nováky production plant, which has evolved to become one of the most modern facilities of its kind in Europe.

The launch of the new production plant of the Spanish company Fábrica de Municiones de Granada brought this Spanish subsidiary of MSM a doubling of production capacity.

Development and Innovations

In 2023, CSG continued to invest into various areas of research and development related to its core business segments. The Group has several hundred employees focused on development; most work on defence and munitions technologies, while some others are advancing aerospace and transportation technologies. In the process, they are cooperating with top scientific and research institutes of leading Czech universities, especially the University of Defence in Brno and expert teams of the Czech armed forces.

Tatra Defence Vehicle has launched new specialized bodies for the Tatra chassis. For its Starkom vehicle designed for electronic warfare and jamming, which has been ordered by the Czech Army, the company has produced armored cabins for vehicle crews and ballistic and mine-protected superstructures for special electronic equipment and its operators. Tatra Defence Vehicle has also cooperated with the Brno-based Military Research Institute (VVU) and other Czech companies, including the military systems manufacturer Retia, on this project. Starkom is one of the most complex vehicles Tatra Defence Vehicle has produced to date.

Last year another company in this division, Karbox, also introduced two unique mobile devices—EWA (Emergency Water from Air) and SAWER (Solar Air Water Earth Resource)—designed to extract water from the air. They were developed in cooperation with experts from the Czech Technical University in Prague. EWA can extract 25–30 liters of water per day in a very dry desert environment and is many times more efficient than any technologically comparable devices worldwide. SAWER produces 280 liters of water per day when deployed in dry desert conditions using solar panels, or approximately 590 liters of water per day when connected to an external power source.

Among the most significant new-product development projects last year was the Tatra Force e-Drive, a hydrogen-powered electric vehicle prototype that Tatra Trucks is developing within a consortium led by ÚJV Řež, a design and engineering services provider. This mining truck is designed to be independent of external power sources: it carries its power source on board.

Last year, Tatra Trucks also introduced its Tatra Force truck, equipped with an automatic driving (AD) system. The ultimate goal of this project is to create a truck capable of autonomous driving. Currently, the company is testing a prototype vehicle with remote control, which may find applications in rescue units and industry.

Social Responsibility and Sustainability

CSG always strives to meet every sustainable-business indicator under the EU taxonomy and international ESG standards. The Group currently monitors its sustainable business performance in accord with GRI standards8; it has already assessed key ESG parameters in the past year under the SASB standard9 and is also preparing to align its reporting with ESRS standards10. The Group also plans to commit to the SBT initiative targets11.

CSG sets its sustainability goals both at the level of the Group overall and within its individual divisions. For Defence and Aerospace these include, among other things, transitioning to advanced technologies that reduce the environmental impact of production and its resulting products, and strengthening safety standards. The CSG Ammo+ division focuses on the introduction of more environmentally friendly materials, including fully biodegradable materials, and waste minimization. The CSG Mobility division focuses on the development of low-emission forms of transport based on electric and hydrogen propulsion. CSG’s manufacturing businesses support the extension of the life cycle of their pre-produced products through a wide range of services, including long-term production of spare parts. All of the Group’s companies have implemented or are implementing measures to strengthen their energy self-sufficiency—by installing their own photovoltaic power sources, heat pumps, and solar-powered cogeneration systems, all in accord with the principles of the “do no harm approach”12.

Starting in 2023, all CSG companies will be obliged to engage in activities of public interest in the localities where they operate, primarily in the form of support for civic and non-profit initiatives and cultural, social, educational, or sports projects. The Group is a proud partner of the “Česká hlava” project, which promotes the outstanding achievements of Czech scientists and innovators. CSG has also been a long-term contributor to research projects at the Institute of Hematology and Blood Transfusion aimed at improving cancer diagnosis and treatment. In the area of education, the Group supports the activities of the CEVRO University and, through strategic partnerships, specific scientific projects of top Czech and Slovak universities in technical fields, including ČVUT, VUT, VŠB-TUO, the University of Defence, UJEP, VŠE, and the University of Pardubice.

CSG’s comprehensive cooperation with the Czech national Integrated Rescue System includes financial, material, and advisory support.

The Group’s companies also support a wide range of local projects nominated by their own employees. (A full overview of this support is contained in the Group’s sustainability report.)

In the realm of sports, the Group has forged new partnerships with top athletes in the shooting disciplines and in biathlon. These include Olympic medalists and other athletes from the top of the world rankings. CSG also supports the Italian Biathlon Association. Its sponsorship of this sport was

enriched earlier this year by CSG’s new partnership with Roman Stanek, a talented young Formula 2 racing driver.

# # #

About CSG

The global industrial and technological group CSG, owned by Czech entrepreneur Michal Strnad, has key production facilities in the Czech Republic, Slovakia, Spain, Italy, India, the UK, and the USA and exports its products worldwide. CSG is continuously investing into the development of its companies while expanding in its core business areas. The Group includes, for example, the Czech truck manufacturer Tatra Trucks, the world’s leading manufacturer of small caliber ammunition Fiocchi, and the Czech radar manufacturer Eldis. More than 10,000 employees work in the companies included in the CSG group and in their associated companies. In 2023, the Group’s consolidated sales reached EUR [1.73] billion. CSG’s main fields of activity are the engineering, automotive, rail, aerospace, and defence industries and small caliber ammunition production. CSG’s products can be found on all continents thanks to its strong export orientation.

Note: CSG’s companies are separated into divisions according to their core business areas: CSG Aerospace (aerospace industry), CSG Defence (defence industry), CSG Ammo+ (small caliber ammunition), CSG Mobility (automotive and rail industry) and CSG Business Projects (companies outside the Group’s core areas).